Hunter Biden's involvement in the Indian Tribal Bond Scam

A Morgan Stanley Whistleblower highlighted Hunter Biden. Why did the SEC choose to focus only on Devin Archer?

Many are aware that Hunter Biden’s long-time business partner, Devon Archer, along with another of Hunter’s associates, Jason Galanis, were convicted in a 2014 scheme involving a Native American Tribal bond offering. But what many don’t realize is the full story of that incident only serves to raise more questions about the involvement of Hunter Biden - and that of his father, Joe Biden.

We’ve always wondered why Hunter was never charged in this scandal - particularly because he was a close partner with Archer - and because their broker-dealer firm, Rosemont Seneca, was effectively sold to Burnham Financial as part of the larger deal involving the complicated tribal bond scheme.

Galanis, who is currently in prison, apparently has the same questions we do: "Galanis testified he believed the federal "prosecution strategy was intended to protect Hunter Biden and, ultimately, Vice President Biden."

Archer, John Galanis, and the five other defendants duped clients into investing more than $43 million in sham bonds issued in 2014 and 2015 by a business affiliate of the Oglala Sioux Nation in South Dakota. The proceeds from the bonds - which included several different offerings - were supposed to be used to build a distribution center and other projects for the tribe, but were instead diverted for the personal use of Galanis, Archer and their other associates. Galanis and his group also sought to use the proceeds from the bonds to effectuate a strategy that involved buying up small financial firms to merge them into a larger entity called the Burnham Financial Group.

In mid-to-late late 2015, the SEC was alerted to a series of suspicious transactions involving Devon Archer, Hunter Biden and Rosemont Seneca by a Wall Street whistleblower employed at Morgan Stanley. Indeed, it’s documents from the whistleblower - which appear to highlight Hunter’s involvement - that make it all the more suspicious that it was only Archer who caught the eye of the feds. Formal charges were filed by the SEC on May 11, 2016 against Archer, Galanis and the rest of the group. But Hunter’s name was conspicuously absent from the charging documents. More on that later.

Archer was originally convicted in June 2018 along with Galanis and Bevan Cooney. But unlike Galanis and Cooney, Archer had his conviction overturned by US District Judge Ronnie Abrams, an Obama appointee who just so-happened to be married to Mueller special counsel prosecutor Greg Andres. At the time, Judge Abrams said she was “left with an unwavering concern that Archer is innocent of the crimes charged.” Judge Abrams’ decision was reversed on appeal and Archer was sentenced to a year and one day in prison.

It looks like that sentence was lenient. As court documents make clear, the Tribal Bond scheme consisted of four parts:

1) Convincing the Wakpamni Lake Community Corporation to issue the Tribal Bonds;

2) Engineering the Tribal Bond issuances to give Galanis and his associates undisclosed control over the Tribal Bond proceeds;

3) Securing victims to purchase the Tribal Bonds; and

4) Misappropriating the Tribal Bond proceeds for the benefit of Galanis and his associates, including the Archer and the other Defendants.

One of the first steps in their scheme was the purchase of two small asset managers - Hughes Capital Management and Atlantic Asset Management - using a subsidiary of their newly created financial roll-up vehicle, Burnham Financial. The total purchase price was small - just a couple million dollars. But with the purchase came a customer base of managed assets that was large enough to be illegally used to purchase the bonds.

Meanwhile, the Native American tribal corporation, the Wakpamni Lake Community Corporation, was convinced to issue three tranches of tribal bonds. This was done in part by providing a falsified annuity contract that the tribe believed contained the funds necessary to pay off the bonds at maturity - and allow for several new development projects for the tribe. But the annuity was actually worthless. It had been issued by an asset-less holding company controlled by Galanis and his associates.

It was all a fraud. The proceeds from the bond deal had gone to Galanis, Archer and his associates and the annuity had no invested funds. To make matters worse, the issuer of the bonds was directly affiliated with the Wakpamni District of the Oglala Sioux Nation, whose members live in one of the poorest regions in the United States. This was not a “victimless” crime.

In total there were three tranches of Tribal Bonds that were issued: $27 million in August 2014; $20 million in September 2014; and $16 million in April 2015. The August and April bond issuances directly defrauded the clients of their newly purchased asset managers [Hughes Capital Management & Atlantic Asset Management] as these clients were used as unwitting purchasers of those bonds by Galanis, Archer and the rest of the group.

But Galanis, Archer and their associates purchased the September 2014 bond offering of $20 million themselves in a process known as “recycling”- using proceeds from the first bond deal to do so. As before, they siphoned off the majority of this money as well - once again using another fictitious annuity contract. As court documents note, the point of this recycling scheme was to “use the bonds as currency in various transactions, including to [fraudulently] bolster Burnham Securities' net capital,” thereby making newly created Burnham Financial appear more fiscally sound than it was.

Remember that after the sale of their broker-dealer firm, Hunter now held a sizable stake in Burnham along with Archer and Galanis. On paper the bonds appeared to be worth at least $20 million - a seemingly real asset that could be sold to other investors. But in reality, Archer and his group were holding $20 million in worthless bonds on their books. They needed to sell them to another investor before their scheme unraveled. This is where Morgan Stanley entered the picture.

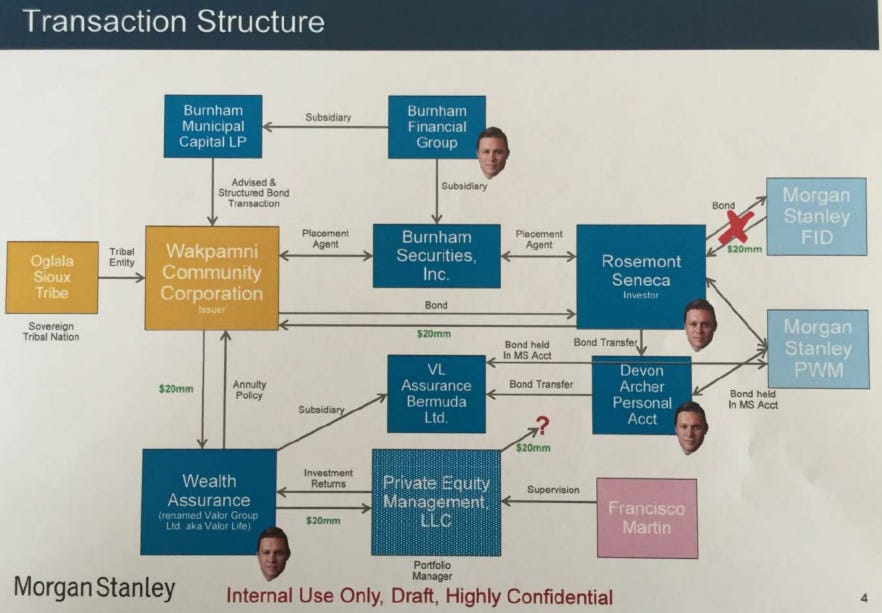

According to an internal Morgan Stanley presentation, their Municipal trading desk was approached on or about December 2014 regarding the possible purchase of a sizable tranche of non-rated municipal bonds that had been issued only three months earlier on Sept 12, 2014. This was the second $20 million tranche of bonds that Archer and Galanis had purchased using the proceeds from the first $27 million bond offering to do so.

Morgan Stanley assigned a High Yield credit analyst to analyze the bonds for possible purchase for their trading desk. The analyst immediately noted a number of red flags. As a result, Morgan Stanley passed on the purchase of the bonds in Dec. 2014. But it also appears that they continued to evaluate the structure and unusual genesis of the bonds for the next five months - getting increasingly disconcerted as they did so.

It’s worth noting that this bond offering was a true private placement - so illiquid that the bonds had never even traded to this point. Another notable item was the price at which Archer and his group were carrying the bonds on their books. Archer and his group had the bonds marked in their portfolio at 111 - a shockingly high valuation for a brand new issue. For perspective, in bond parlance, par value - generally also the new issue price - is 100. To have illiquid bonds that had been issued just three months earlier trading at these kinds of lofty levels is almost unheard of.

It’s clear what happened. Archer and his associates had marked the bonds up substantially in their portfolio in the intervening 2-3 months based on zero trades - almost certainly as a means of making their investors who had purchased the other two bond offerings believe the new bonds were valuable - when in fact they were worthless. If there are any holders of the portfolio beyond the seller (as there was in this case), this pricing scheme is illegal in its own right.

Although Archer and his group were carrying the bonds at 111% of par, according to Morgan Stanley they were initially willing to sell the bonds around par - but very quickly dropped their asking price to 80 with indications they would be willing to go even lower. It’s hard to impress on someone outside the business just how out of bounds this is. No wonder Morgan Stanley found themselves alarmed.

Morgan Stanley likely became even more alarmed when they began to examine the underlying transaction structure. It was highly complex and involved offshore holding companies. Money was moving about amongst various holding company structures - ultimately in circular fashion back to Archer, Galanis and their associates. There was also a Ponzi Scheme at play for good measure as Galanis continued to scrounge up new proceeds to pay interest on the older bonds.

Morgan Stanley had pretty quickly figured out the "recycling scheme" along with the rest of the fraud being perpetrated by Archer, Galanis and the rest of their group. It would take a bit of time, but the Morgan Stanley analyst eventually reported his findings to the Securities & Exchange Commission, who began a larger investigation.

Archer later claimed that he "was not paying enough attention" and didn’t realize what was happening. This seems an implausible claim. Given the use of his personal company to channel funds and hold the bonds, it's impossible for us to accept that he was unaware all of this was highly illegal.

We would also argue that the same logic would apply to Hunter - although he has always denied any involvement in the transactions. Hunter was Archer’s long-time partner - and both men seemed to be involved in every facet of the others’ business.

In a Burnham slide on the ongoing consolidations that lay behind the bond offerings, there is the line “H. Biden broker dealer tuck-under enhances relationships.” There is also an email from Archer to Hunter in July 2014 where Archer tells Hunter “a consolidated Burnham which would buy our BD [broker dealer] as a subsequent, what we’re calling, “strategic H Biden tuck in.” Hunter responded, “Looks like a great plan.”

Also notable is the fact that Morgan Stanley went to the trouble of singling out Hunter and placed his biography prominently above Archer’s in their analysis of the bond deal. Archer appears to have been made the "face" of the transaction and held the account from which Archer and his associates hoped to sell the bonds to Morgan Stanley’s Municipal trading desk. But Morgan Stanley appeared to view Hunter as the principal.

It's always bothered us that Hunter was never charged along with Archer by the SEC. We know that Hunter received a subpoena from the SEC on the tribal bonds matter in March 2016. We also know that in his April 20, 2016 response to the SEC, Hunter and his lawyers invoked Joe Biden's name:

“As a threshold matter, we request that you treat this matter with the highest degree of confidentiality, consistent with Commission policy and applicable law. The confidential nature of this investigation is very important to our client and it would be unfair, not just to our client, but also to his father, the Vice President of the United States, if his involvement in an SEC investigation and parallel criminal probe were to become the subject of any media attention.”

Archer and Galanis were charged by the SEC on May 11, 2016 - just two weeks after Hunter’s response to the SEC subpoena. But, miraculously, Hunter was never mentioned again.

As we noted earlier, it appears Morgan Stanley also believed that Hunter was directly involved. They singled out Hunter and placed his biography prominently above Archer’s in their analysis of the bond deal. What are the odds that a prestigious wall street firm would not only include - but choose to highlight - the name of the vice-president’s son in their approach to the SEC unless they were certain of his involvement?

One final item. On the same day the SEC’s criminal complaint against Archer and Galanis was released - along with a concurrent Wall Street Journal article - Hunter was sent an email from Eric Schwerin. In the May 11, 2016 email Schwerin told Hunter, “There are no allegations you had anything to do with this, only that you do business together. Still not good but not sure how we push back without inviting more questions."

Make of that what you will.